On the morning of Monday, August 13, 2012, Scott Stevens loaded a brown hunting bag into his Jeep Grand Cherokee, then went to the master bedroom, where he hugged Stacy, his wife of 23 years. “I love you,” he told her.

Stacy thought that her husband was off to a job interview followed by an appointment with his therapist. Instead, he drove the 22 miles from their home in Steubenville, Ohio, to the Mountaineer Casino, just outside New Cumberland, West Virginia. He used the casino ATM to check his bank-account balance: $13,400. He walked across the casino floor to his favorite slot machine in the high-limit area: Triple Stars, a three-reel game that cost $10 a spin. Maybe this time it would pay out enough to save him.

It didn’t. He spent the next four hours burning through $13,000 from the account, plugging any winnings back into the machine, until he had only $4,000 left. Around noon, he gave up.

Stevens, 52, left the casino and wrote a five-page letter to Stacy. A former chief operating officer at Louis Berkman Investment, he gave her careful financial instructions that would enable her to avoid responsibility for his losses and keep her credit intact: She was to deposit the enclosed check for $4,000; move her funds into a new checking account; decline to pay the money he owed the Bellagio casino in Las Vegas; disregard his credit-card debt (it was in his name alone); file her tax returns; and sign up for Social Security survivor benefits. He asked that she have him cremated.

He wrote that he was “crying like a baby” as he thought about how much he loved her and their three daughters. “Our family only has a chance if I’m not around to bring us down any further,” he wrote. “I’m so sorry that I’m putting you through this.”

He placed the letter and the check in an envelope, drove to the Steubenville post office, and mailed it. Then he headed to the Jefferson Kiwanis Youth Soccer Club. He had raised funds for these green fields, tended them with his lawn mower, and watched his daughters play on them.

Stevens parked his Jeep in the gravel lot and called Ricky Gurbst, a Cleveland attorney whose firm, Squire Patton Boggs, represented Berkman, where Stevens had worked for 14 years—until six and a half months earlier, when the firm discovered that he had been stealing company funds to feed his gambling habit and fired him.

Stevens had a request: “Please ask the company to continue to pay my daughters’ college tuition.” He had received notification that the tuition benefit the company had provided would be discontinued for the fall semester. Failing his daughters had been the final blow.

Gurbst said he would pass along the request.

Then Stevens told Gurbst that he was going to kill himself.

“What? Wait.”

“That’s what I’m going to do,” Stevens said, and promptly hung up.

He next called J. Timothy Bender, a Cleveland tax attorney who had been advising him on the IRS’s investigation into his embezzlement. Up until that point, he had put on a brave face for Bender, saying he would accept responsibility and serve his time. Now he told Bender what he was about to do. Alarmed, Bender tried to talk him out of it. “Look, this is hard enough,” Stevens said. “I’m going to do it.” Click.

At 4:01 p.m., Stevens texted Stacy. “I love you.” He then texted the same message to each of his three daughters in succession.

He took off his glasses, his glucose monitor, and his insulin pump—Stevens was a diabetic—and tucked them neatly into his blue thermal lunch bag with the sandwich and apple he hadn’t touched.

He unpacked his Browning semiautomatic 12-gauge shotgun, loaded it, and sat on one of the railroad ties that rimmed the parking lot.

Then he dialed 911 and told the dispatcher his plan.

Scott Stevens hadn’t always been a gambler. A native of Rochester, New York, he earned a master’s degree in business and finance at the University of Rochester and built a successful career. He won the trust of the steel magnate Louis Berkman and worked his way up to the position of COO in Berkman’s company. He was meticulous about finances, both professionally and personally. When he first met Stacy, in 1988, he insisted that she pay off her credit-card debt immediately. “Your credit is all you have,” he told her.

They married the following year, had three daughters, and settled into a comfortable life in Steubenville thanks to his position with Berkman’s company: a six-figure salary, three cars, two country-club memberships, vacations to Mexico. Stevens doted on his girls and threw himself into causes that benefited them. In addition to the soccer fields, he raised money to renovate the middle school, to build a new science lab, and to support the French Club’s trip to France. He spent time on weekends painting the high-school cafeteria and stripping the hallway floors.

Stevens got his first taste of casino gambling while attending a 2006 trade show in Las Vegas. On a subsequent trip, he hit a jackpot on a slot machine and was hooked.

Scott and Stacy soon began making several trips a year to Vegas. She liked shopping, sitting by the pool, even occasionally playing the slots with her husband. They brought the kids in the summer and made a family vacation of it by visiting the Grand Canyon, the Hoover Dam, and Disneyland. Back home, Stevens became a regular at the Mountaineer Casino. Over the next six years, his gambling hobby became an addiction. Though he won occasional jackpots, some of them six figures, he lost far more—as much as $4.8 million in a single year.

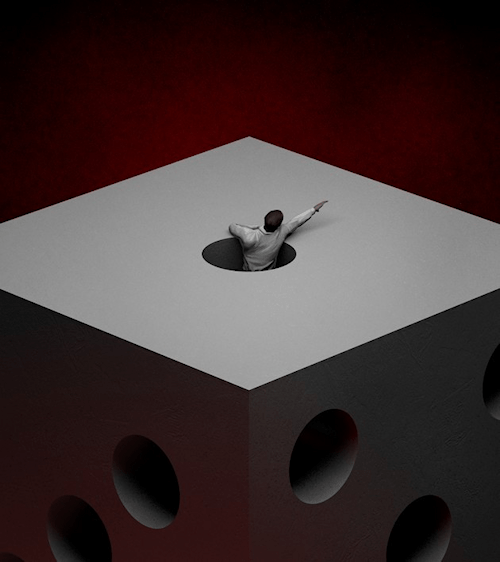

Did Scott Stevens die because he was unable to rein in his own addictive need to gamble? Or was he the victim of a system carefully calibrated to prey on his weakness?

Stevens methodically concealed his addiction from his wife. He handled all the couple’s finances. He kept separate bank accounts. He used his work address for his gambling correspondence: W-2Gs (the IRS form used to report gambling winnings), wire transfers, casino mailings. Even his best friend and brother-in-law, Carl Nelson, who occasionally gambled alongside Stevens, had no inkling of his problem. “I was shocked when I found out afterwards,” he says. “There was a whole Scott I didn’t know.”

When Stevens ran out of money at the casino, he would leave, write a company check on one of the Berkman accounts for which he had check-cashing privileges, and return to the casino with more cash. He sometimes did this three or four times in a single day. His colleagues did not question his absences from the office, because his job involved overseeing various companies in different locations. By the time the firm detected irregularities and he admitted the extent of his embezzlement, Stevens—the likable, responsible, trustworthy company man—had stolen nearly $4 million.

Stacy had no idea. In Vegas, Stevens had always kept plans to join her and the girls for lunch. At home, he was always on time for dinner. Saturday mornings, when he told her he was headed into the office, she didn’t question him—she knew he had a lot of responsibilities. So she was stunned when he called her with bad news on January 30, 2012. She was on the stairs with a load of laundry when the phone rang.

“Stace, I have something to tell you.”

She heard the burden in his voice. “Who died?”

“It’s something I have to tell you on the phone, because I can’t look in your eyes.”

He paused. She waited.

“I might be coming home without a job today. I’ve taken some money.”

“For what?”

“That doesn’t matter.”

“How much? Ten thousand dollars?”

“No.”

“More? One hundred thousand?”

“Stace, it’s enough.”

Stevens never did come clean with her about how much he had stolen or about how often he had been gambling. Even after he was fired, Stevens kept gambling as often as five or six times a week. He gambled on his wedding anniversary and on his daughters’ birthdays. Stacy noticed that he was irritable more frequently than usual and that he sometimes snapped at the girls, but she figured that it was the fallout of his unemployment. When he headed to the casino, he told her he was going to see his therapist, that he was networking, that he had other appointments. When money appeared from his occasional wins, he claimed that he had been doing some online trading. While they lived off $50,000 that Stacy had in a separate savings account, he drained their 401(k) of $150,000, emptied $50,000 out of his wife’s and daughters’ ETrade accounts, maxed out his credit card, and lost all of a $110,000 personal loan he’d taken out from PNC Bank.

Stacy did not truly understand the extent of her husband’s addiction until the afternoon three police officers showed up at her front door with the news of his death.

Afterward, Stacy studied gambling addiction and the ways slot machines entice customers to part with their money. In 2014, she filed a lawsuit against both Mountaineer Casino and International Game Technology, the manufacturer of the slot machines her husband played. At issue was the fundamental question of who killed Scott Stevens. Did he die because he was unable to rein in his own addictive need to gamble? Or was he the victim—as the suit alleged—of a system carefully calibrated to prey upon his weakness, one that robbed him of his money, his hope, and ultimately his life?

Less than 40 years ago, casino gambling was illegal everywhere in the United States outside of Nevada and Atlantic City, New Jersey. But since Congress passed the Indian Gaming Regulatory Act in 1988, tribal and commercial casinos have rapidly proliferated across the country, with some 1,000 now operating in 40 states. Casino patrons bet more than $37 billion annually—more than Americans spend to attend sporting events ($17.8 billion), go to the movies ($10.7 billion), and buy music ($6.8 billion) combined.

The preferred mode of gambling these days is electronic gaming machines, of which there are now almost 1 million nationwide, offering variations on slots and video poker. Their prevalence has accelerated addiction and reaped huge profits for casino operators. A significant portion of casino revenue now comes from a small percentage of customers, most of them likely addicts, playing machines that are designed explicitly to lull them into a trancelike state that the industry refers to as “continuous gaming productivity.” (In a 2010 report, the American Gaming Association, an industry trade group, claimed that “the prevalence of pathological gambling … is no higher today than it was in 1976, when Nevada was the only state with legal slot machines. And, despite the popularity of slot machines and the decades of innovation surrounding them, when adjusted for inflation, there has not been a significant increase in the amount spent by customers on slot-machine gambling during an average casino visit.”)

“The manufacturers know these machines are addictive and do their best to make them addictive so they can make more money,” says Terry Noffsinger, the lead attorney on the Stevens suit. “This isn’t negligence. It’s intentional.”

Noffsinger, 72, has been here before. A soft-spoken personal-injury attorney based in Indiana, he has filed two previous lawsuits against casinos. In 2001, he sued Aztar Indiana Gaming, of Evansville, on behalf of David Williams, then 51 years old, who had been an auditor for the State of Indiana. Williams began gambling after he received a $20 voucher in the mail from Casino Aztar. He developed a gambling addiction that cost him everything, which in his case amounted to about $175,000. Noffsinger alleged that Aztar had violated the 1970 Racketeer Influenced and Corrupt Organizations Act by engaging in a “pattern of racketeering activity”—using the mail to defraud Williams with continued enticements to return to the casino. But the U.S. District Court for the Southern District of Indiana granted summary judgment in favor of Aztar, and the U.S. Court of Appeals for the Seventh Circuit instructed the district court to dismiss the case, declaring, “Even if the statements in these communications could be considered ‘false’ or ‘misrepresentations,’ it is clear that they are nothing more than sales puffery on which no person of ordinary prudence and comprehension would rely.”

Four years later, Noffsinger filed a suit on behalf of Jenny Kephart, then 52 years old, against Caesars Riverboat Casino, in Elizabeth, Indiana, alleging that the casino, aware that Kephart was a pathological gambler, knowingly enticed her into gambling in order to profit from her addiction. Kephart had filed for bankruptcy after going broke gambling in Iowa, and moved to Tennessee. But after she inherited close to $1 million, Caesars began inviting her to the Indiana riverboat casino, where she gambled away that inheritance and more. When the casino sued her for damages on the money she owed, Kephart countersued. She denied the basis of the Caesars suit on numerous grounds, including that by giving her “excessive amounts of alcohol … and then claiming that it was injured by her actions or inactions,” Caesars waived any claim it might have had for damages under Indiana law. Although Kephart ultimately lost her countersuit, the case went all the way to the Indiana Supreme Court, which ruled in 2010 that the trial court had been mistaken in denying Caesars’s motion to dismiss her counterclaim. “The existence of the voluntary exclusion program,” the judge wrote, referring to the option Indiana offers people to ban themselves from casinos in the state, “suggests the legislature intended pathological gamblers to take personal responsibility to prevent and protect themselves against compulsive gambling.” (Caesars did not respond to repeated requests for comment.)

Noffsinger had been planning to retire before he received Stacy Stevens’s phone call. But after hearing the details of Scott Stevens’s situation—which had far more serious consequences than his previous two cases—he eventually changed his mind. Unlike in his earlier gambling cases, however, he decided to include a products-liability claim in this one, essentially arguing that slot machines are knowingly designed to deceive players so that when they are used as intended, they cause harm.

In focusing on the question of product liability, Noffsinger was borrowing from the rule book of early antitobacco litigation strategy, which, over the course of several decades and countless lawsuits, ultimately succeeded in getting courts to hold the industry liable for the damage it wrought on public health. Noffsinger’s hope was to do the same with the gambling industry. When Noffsinger filed the Stevens lawsuit, John W. Kindt, a professor of business and legal policy at the University of Illinois at Urbana-Champaign, described it as a potential “blockbuster case.”

Even by the estimates of the National Center for Responsible Gaming, which was founded by industry members, 1.1 to 1.6 percent of the adult population in the United States—approximately 3 million to 4 million Americans—has a gambling disorder. That is more than the number of women living in the U.S. with a history of breast cancer. The center estimates that another 2 to 3 percent of adults, or an additional 5 million to 8 million Americans, meets some of the American Psychiatric Association’s criteria for addiction but have not yet progressed to the pathological, or disordered, stage. Others outside the industry estimate the number of gambling addicts in the country to be higher.

Such addicts simply cannot stop themselves, regardless of the consequences. “When you’re dealing with an addict active in their addiction, they’ve lost all judgment,” says Valerie Lorenz, the author of Compulsive Gambling: What’s It All About? “They can’t control their behavior.”

Gambling is a drug-free addiction. Yet despite the fact that there is no external chemical at work on the brain, the neurological and physiological reactions to the stimulus are similar to those of drug or alcohol addicts. Some gambling addicts report that they experience a high resembling that produced by a powerful drug. Like drug addicts, they develop a tolerance, and when they cannot gamble, they show signs of withdrawal such as panic attacks, anxiety, insomnia, headaches, and heart palpitations.

Approximately 3 million to 4 million Americans are pathological gamblers—and one in five gambling addicts attempts suicide.

Neuroscientists have discovered characteristics that appear to be unique to the brains of addicts, particularly in the dopaminergic system, which includes reward pathways, and in the prefrontal cortex, which exerts executive control over impulses. “We’ve seen a disregulated reward system,” says Jon Grant, a professor in the department of psychiatry and behavioral neuroscience at the University of Chicago. “The frontal parts of the brain that tell us ‘Hey, stop!’ are less active, and parts that anticipate rewards tend to be stronger.”

Gambling addicts may have a genetic predisposition, though a specific marker has not yet been uncovered. Environmental factors and personality traits—a big gambling win within the past year, companions who gamble regularly, impulsivity, depression—may also contribute to the development of a gambling problem. Whatever the causes, there’s widespread agreement that certain segments of the population are simply more vulnerable to addiction. “You can’t turn on and turn off certain activities of the brain,” says Reza Habib, a psychology professor at Southern Illinois University. “It’s an automatic physiological response.”

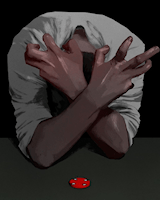

Scott Stevens’s story is not anomalous. Given the guilt and shame involved, gambling addiction frequently progresses to a profound despair. The National Council on Problem Gambling estimates that one in five gambling addicts attempts suicide—the highest rate among addicts of any kind. There are no accurate figures for suicides related to gambling problems, but there are ample anecdotes: the police officer who shot himself in the head at a Detroit casino; the accountant who jumped to his death from a London skyscraper in despair over his online-gambling addiction; the 24-year-old student who killed himself in Las Vegas after losing his financial-aid money to gambling; and, of course, Stevens himself.

Problem gamblers are worth a lot of money to casinos. According to some research, 20 percent of regular gamblers are problem or pathological gamblers. Moreover, when they gamble, they spend—which is to say, lose—more than other players. At least nine independent studies demonstrate that problem gamblers generate anywhere from 30 to 60 percent of total gambling revenues.

Casinos know exactly who their biggest spenders are. According to a 2001 article in Time magazine, back in the 1990s casino operators bought records from credit-card companies and mailing lists from direct-mail marketers. One of the latter, titled the “Compulsive Gamblers Special,” promised to deliver the names of 200,000 people with “unquenchable appetites for all forms of gambling.” The casinos used these records and lists to target compulsive gamblers—as Caesars was alleged to have done with Jenny Kephart.

These days, the casinos have their own internal methods for determining who their most attractive customers are. According to Natasha Dow Schüll, an NYU professor who spent more than 15 years researching the industry, culminating in her 2012 book, Addiction by Design: Machine Gambling in Las Vegas, 70 percent of patrons now use loyalty cards, which allow the casinos to track such data points as how frequently they play electronic gaming machines, how long they play, how much they bet, how often they win and lose, what times of day they visit, and so on. Each time a patron hits the Spin or the Deal button, which can be as frequently as 900 to 1,200 times an hour, the casino registers the data. Even gamblers who choose to forgo loyalty cards do not necessarily escape the casino’s watchful eye. In some machines, miniature cameras watch their faces and track their playing behavior.

Several companies supply casinos with ATMs that allow patrons to withdraw funds through both debit and cash-advance functions, in some cases without ever leaving the machines they are playing. (Some of the companies also sell information on their ATM customers to the casinos.) “The whole premise of the casino is to get people to exceed their limits,” says Les Bernal, the national director of the advocacy organization Stop Predatory Gambling. “If you’re using the casino ATM, it’s like painting yourself orange.”

All of these data have enabled casinos to specifically target their most reliable spenders, primarily problem gamblers and outright addicts. Despite those customers’ big losses—or rather, because of their losses—the casinos lure them to return with perks that include complimentary drinks and meals, limo service, freebies from the casino gift shop, golf excursions for their nongambling spouses, and in some cases even first-class airfare and suites in five-star hotels. They also employ hosts who befriend large spenders and use special offers to encourage them to stay longer or return soon. Some hosts receive bonuses that are tied to the amount customers spend beyond their expected losses, which are calculated using the data gathered from previous visits. As Richard Daynard, a law professor at Northeastern University and the president of the Public Health Advocacy Institute, explained at the group’s forum on casino gambling in the fall of 2014, “The business plan for casinos is not based on the occasional gambler. The business plan for casinos is based on the addicted gambler.”

Casinos have developed formulas to calculate the “predicted lifetime value” of any given individual gambler. Gamblers are assigned value rankings based on this amount; the biggest losers are referred to as “whales.” These gamblers become the casinos’ most sought-after repeat customers, the ones to whom they market most aggressively with customized perks and VIP treatment.

Caroline Richardson, for example, became a whale for the Ameristar Casino in Council Bluffs, Iowa. In 2011 alone, she lost nearly $2 million, primarily on the casino’s slot machines. The casino allegedly allowed her to go behind the cashier’s “cage,” an area normally off-limits to patrons, to collect cash to gamble. It increased the limits on some slot machines so that she could spend more on single games. It also made a new machine off-limits to other customers so that Richardson could be the first to play it. Management assigned Richardson an executive host, who offered her free drinks, meals, hotel stays, and tickets to entertainment events.

So claimed a suit brought against the casino by Richardson’s employer, Colombo Candy & Tobacco Wholesale. Richardson, the company’s controller, embezzled $4.1 million over the course of two years to support her gambling addiction. (In 2014, Richardson, then 54, was sentenced to 14 to 20 years in prison for the crime.) The thefts ultimately put the company out of business. The suit claimed that the casino had ample reason to presume that Richardson, who earned about $62,000 a year, had come into the money she gambled by fraudulent means. (A representative for Ameristar Casino declined to comment on the lawsuit.)

The U.S. District Court for Nebraska agreed that Colombo had sufficiently proved its initial claim of unjust enrichment, which the casino would have to defend itself against. The suit, however, stalled when Colombo’s president and CEO, Monte Brown, and his wife, Jenise, ran out of money to pay their attorneys and had to file for personal bankruptcy. “They found someone who had the addiction and the ability to steal, and they exploited it,” Monte Brown says. “The casino embezzled from us through an employee.” Jenise adds, “For people to do that to other people, it’s evil.”

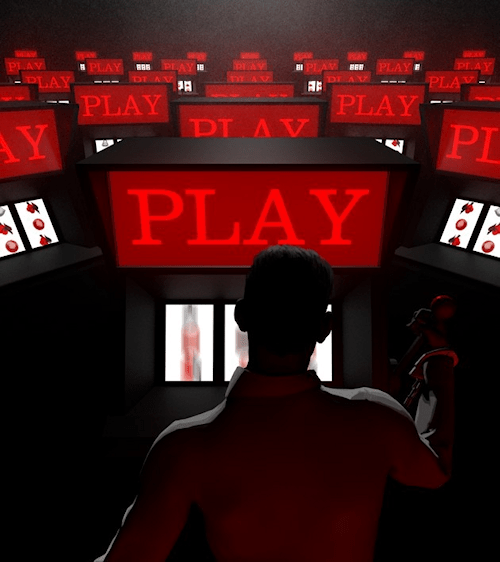

Walk into the Mountaineer Casino in West Virginia, and the slot machines overwhelm you—more than 1,500 of them, lights blinking, animated screens flashing, the simulated sound of clinking coins blaring across the floor. The machines have names such as King Midas, Rich Devil, Cash Illusions, Titanic, and Wizard of Oz. It’s a Tuesday afternoon, and here inside the windowless, clockless, cavernous space, a few patrons are clustered around a craps table, a roulette table, and a handful of card tables. But the vast majority sit at the slot machines. Slots and video poker have become the lifeblood of the American casino. They generate nearly 70 percent of casino revenues, according to a 2010 American Gaming Association report, up from 45 percent four decades ago. Three out of five casino visitors say their favorite activity is playing electronic gaming machines. Their popularity spells profits not only for casinos but for manufacturers as well. International Game Technology, which, as the world’s largest manufacturer of slot machines, has made many of the 900,000-plus slot machines in the U.S., earned $2.1 billion in revenues in fiscal year 2014. (That year, Gtech, an Italian lottery company, acquired IGT and adopted its name in a $6.4 billion deal.)

These are not your grandma’s one-armed bandits. Today’s electronic gaming machines, or EGMs, feature highly sophisticated computers driven by complex algorithms. Old-fashioned three-reel slot machines consisted of physical reels that were set spinning by the pull of a lever. Each reel would have, for example, 22 “stops”: 11 different symbols, and 11 blank spaces between the symbols, for a total of 10,648 possible combinations. If the same symbol aligned on the payline on all three reels when they stopped spinning, the player would win a jackpot that varied in size depending on the symbol. The odds were straightforward and not terribly hard to calculate.

The big breakthrough in slots technology was the invention of “virtual reel mapping” in 1982. According to NYU’s Schüll, about 20 to 30 percent of slot machines today resemble the old-fashioned ones, with physical spinning reels. But where each reel stops is no longer determined by the force of a good pull of the lever. Rather, a computer chip within the machine chooses an outcome using “virtual reels,” which may include different quantities of the various symbols—more blank spaces, for instance, and fewer symbols for big jackpots. The physical reels are not spinning until they run out of momentum, as it might appear. Rather, the chips “tell” them where to stop the moment a customer pulls the lever or pushes the button. Thus it is possible for game designers to reduce the odds of hitting a big jackpot from 1 in 10,648 to 1 in 137 million. Moreover, it is almost impossible for a slots player to have any idea of the actual odds of winning any jackpot, however large or small.

Virtual reel mapping has also enabled a deliberately misleading feature, the “near miss.” That’s when a jackpot symbol appears directly above or below the payline. The intent is to give the player the impression of having almost won—when, in fact, he or she is no closer to having won than if the symbol had not appeared on the reel at all. Some slot machines are specifically programmed to offer up this near-miss result far more often than they would if they operated by sheer chance, and the psychological impact can be powerful, leading players to think, I was so close. Maybe next time. (As I. Nelson Rose, a professor at Whittier Law School and the author of Gambling and the Law, has written, Nevada regulations operate on the theory that a sophisticated player would be able to tell the real odds of winning by playing a machine long enough. The gambling industry maintains that deceptive near misses do not occur in North American gaming machines, but as Schüll has noted, it has developed a more narrow definition of deceptive near misses, which still allows for “subliminal inducements.”)

“The business plan for casinos is not based on the occasional gambler. The business plan for casinos is based on the addicted gambler.”

Research has shown that an elevated number of near-miss results does increase playing time. Indeed, as early as 1953, B. F. Skinner, the godfather of modern behaviorism, noted, “ ‘Almost hitting the jack pot’ increases the probability that the individual will play the machine.” This effect is even stronger for gambling addicts, whose brains respond to near misses more like wins than like losses. “The near misses [trigger] the same brain response as a win,” says Reza Habib, the Southern Illinois University psychology professor.

Yet another feature made possible by virtual reel mapping is the uneven distribution of winning symbols among virtual reels, known as “starving reels.” For instance, a 7 may come up four times on the first virtual reel and five times on the second but only once on the third. The first two reels are thus much more likely to hit a 7 than the last one, but you wouldn’t know this by looking at the physical reels. Just as the craps player expects the dice to be numbered 1 to 6 and the blackjack player expects the dealer to use conventional decks of 52 cards, it’s natural for the slot-machine player to expect equal odds on each of the reels, says Roger Horbay, a former gambling-addiction therapist and an expert on electronic gaming machines. “Unbalanced reel design enables EGMs to present to the player screens which are rich in symbols but which are designed to limit winning combinations in a manner incommensurate with the appearance of the screen,” Horbay writes in “Unbalanced Reel Gaming Machines,” a paper he co-authored with Tim Falkiner in 2006.

Astonishingly, the patent application for virtual reel mapping, the technology that made all these deceptive practices possible, was straightforward about its intended use: “It is important,” the application stated, “to make a machine that is perceived to present greater chances of payoff than it actually has within the legal limitations that games of chance must operate.” Countries such as Australia and New Zealand have outlawed virtual reel mapping because of the harm the inherent deception inflicts upon players.

In the United States, by contrast, the federal government granted the patent for virtual reel mapping in 1984. IGT purchased the rights to it in 1989 and later licensed the patent to other companies. “Imagine sitting around a boardroom table, thinking of what’s fair, and coming up with this,” says Kevin Harrigan, a co-director of a gambling-research lab at the University of Waterloo, in Ontario. “It just seems wrong to me.”

The Nevada State Gaming Control Board approved virtual-reel slot machines in 1983. Interestingly, during hearings on the subject, Ray Pike, the attorney representing IGT—the very company that would subsequently buy the rights to the patent for virtual reel mapping and manufacture hundreds of thousands of slot machines—called these overrepresented near misses “false advertising,” adding, “There is a deception involved with this kind of a machine.” Yet he also stated that if the board approved virtual reel mapping, “certainly we would like to be able to do that”—create the appearance of near misses above and below the payline—“because I think that is a competitive advantage.”

Of course, classic, spinning-reel slot machines make up only a fraction of the electronic gaming machines available at most casinos. Technology has evolved such that many machines lack physical reels altogether, instead merely projecting the likenesses of spinning symbols onto a video screen. These machines allow “multiline” play, an innovation that became common in the 1990s. Instead of betting on one simple payline, players are able to bet on multiple patterns of paylines—as many as 200 on some machines. This allows for more opportunities to win, but the results are often deceptive. For instance, if you bet $1 on each of five different patterns and then get a $3 payout on one pattern, the machine will treat you like a winner, with flashing lights and congratulatory videos and the requisite clinking of virtual coins. The reality, of course, is that you have lost $2.

“The brain somehow registers a win,” Kevin Harrigan says. “No matter what you think, physically you’re being affected by these things—the lights, the sounds, the graphics—as a win. You can get 150 to 200 of these false wins, which we also call losses, an hour. That’s a lot of positive reinforcement.”

Losses disguised as wins also create a “smoother ride,” as some within the industry call it, allowing a machine to slowly deplete a player’s cash reserves, rather than taking them in a few large swipes. Because the machine is telling the player he or she is winning, the gradual siphoning is less noticeable.

Related to the video slot machines are video-poker terminals, which IGT began popularizing in 1979. The standard five-card-draw game shows five cards, each offering players the option to hold or replace by drawing a card from the 47 remaining in the virtual deck. The games require more skill—or at least a basic understanding of probabilities—than the slot machines do. As such, they appeal to people who want to have some sense of exerting control over the outcome.

But over time, designers of video-poker machines discovered that they could influence gamblers’ behavior by manipulating game details. They saw, for instance, patrons going more often for four of a kind than the royal flush, a rarer but more lucrative hand, and they adjusted the machines accordingly. Video poker also offers its own version of losses disguised as wins. Today’s “multihand” video-poker machines—triple-play, 10-play, and even 100-play—allow patrons to play multiple hands simultaneously. This creates an experience similar to multiline slots, in which players are likely to “win back” a portion of each bet by frequently hitting small pots even as they are steadily losing money overall.

Regardless of the machine—slots, video poker—casinos’ ultimate goal is to maximize players’ “time on device.” This is crucial for casinos, because given enough time, the house always wins. Local regulations typically stipulate that machines must pay out 85 to 95 percent of the bets placed on them—which means that for every $100 inserted into the machine, on average, the player will lose $5 to $15. Whatever the exact figure, the house odds make it such that if a player plays long enough, she will eventually lose her money.

Technological innovations have not only rendered electronic gaming machines wildly profitable; they have also, according to experts, made them more addictive. “They’re creating problem gamblers as much as they are preying upon problem gamblers,” says Natasha Schüll.

A crucial element in modern gambling machines is speed. Individual hands or spins can be completed in just three or four seconds. Wander through a casino at almost any hour, and you’ll see people transfixed before the machines, their fingers poised over the buttons, jabbing at them like rats in cages. The ability to immediately access additional cash at many machines “shrink[s] the time that transpires between a player’s impulse to continue gambling and the means to continue gambling, thus minimizing the possibility for reflection and self-stopping that might arise in that pause,” Schüll writes in Addiction by Design. They’re lulled into a “state of suspended animation that gamblers call the zone.”

For many gambling addicts, the zone itself becomes more desirable even than winning. Schüll describes it as “a state of ongoing, undiminished possibility that came to trump the finite reward of a win.” The zone provides an escape from life’s daily troubles, from past trauma, and even from the gambling debt accumulating with each spin. Players have gone for 14, 15, 16 hours or more playing continuously. They have become so absorbed in the machines that they left their young children unattended in cars, wet themselves without noticing, and neglected to eat for hours.

Casinos and game designers have come up with many ways to keep patrons at their machines and playing rapidly. The chairs are ergonomically designed so that someone can sit comfortably for long stretches. Winnings can be converted back to credits or printed on vouchers to be redeemed later. Waitresses come by to take drink orders, obviating the need for players to get up at all.

The all-consuming nature of electronic gaming machines also speeds up the onset of addiction, which has earned slot machines descriptions such as “electronic morphine” and the “crack cocaine of gambling.” Schüll notes that a 2002 study showed that “individuals who regularly played video gambling devices became addicted three to four times more rapidly than other gamblers (in one year, versus three and a half years), even if they had regularly engaged in other forms of gambling in the past without problems.”

Public-policy advocates compare slot machines to cigarettes. Both, they claim, are products specifically and deliberately engineered to have addictive properties that are known to hook users. “The EGM and tobacco industries intend users to consume their products in precisely the ways that directly, and without further mediation, initiate the [causal] chain that results in known harms,” writes James Doughney, a professorial fellow in economics at Victoria University, in Melbourne, in a 2007 paper published in the International Journal of Mental Health and Addiction.

Regardless of whatever “pleasures” smoking and EGMs may provide, it is true that both products also cause death … Almost all smokers will smoke potentially lethal amounts. The EGM product, used precisely as intended, will cause users to lose control of time and money in sufficient numbers for the industry to flourish.

Cigarette manufacturers were held accountable for the health problems caused by their product after Jeffrey Wigand, a former executive at the tobacco company Brown & Williamson, spoke out in the mid-1990s about the way his firm had manipulated the levels of nicotine to make cigarettes more addictive.

Terry Noffsinger’s legal team grasped the similarities, going so far as to bring on board Sharon Y. Eubanks, an attorney with the West Virginia law firm Bordas & Bordas. Eubanks was the lead counsel for the Justice Department in successful federal litigation against the tobacco industry between 2000 and 2005. She joined Noffsinger in representing Stacy Stevens after he convinced her that the deception used by the gambling industry paralleled that of the tobacco industry. “The tobacco and gambling industries are basically working from the same playbook, using highly engineered products to hook consumers,” Eubanks says.

Casinos are highly attentive to their patrons’ “pain points”—the moments when they are getting close to giving up. The data they track in real time on player cards alert them to these pain points: a big loss, for instance, or when credits start to run low after a dry run. Hosts are also on the lookout for telling behavior, such as someone striking a machine in frustration or slumping over it in discouragement. When hosts spot someone in a state like this, they may swoop in and offer a voucher for some free credits, a drink, or perhaps a meal in the restaurant, where the player can take a break until the resistance passes and he can resume gambling. The hosts may also offer encouraging words such as You’ll win it back. “To me, that is the most vile and venal example of the casino’s intention to trap and keep captive problem and addictive gamblers,” Lissy Friedman, a senior staff attorney at the Public Health Advocacy Institute, said at the group’s 2014 forum.

When players do exhaust all their funds, casinos will sometimes loan them additional money. This is what happened to Noffsinger’s former client Jenny Kephart. In 2006, she spent an entire night gambling at Caesars Riverboat Casino, drinking strong alcoholic beverages provided for free. When she eventually came to the end of her money playing blackjack, the casino offered her a counter check, basically a promissory note, to enable her to keep playing. She signed the check and gambled away the money. That happened five more times. By the end of the night, she had racked up $125,000 in debt owed to the casino. When she couldn’t repay it, the casino sued her. Noffsinger countersued on her behalf. After Kephart’s suit was dismissed, the casino’s original suit was settled confidentially.

Players become so absorbed in the machines that they leave young children unattended, wet themselves without noticing, and neglect to eat for hours.

Experts say casinos should be aware that when they extend credit to losing patrons, they are by definition enabling problem gamblers. “Any gambler who seeks credit for continued gambling has automatically fulfilled one (and perhaps three) of the ten diagnostic criteria established by the American Psychiatric Association for a ‘pathological gambler’ (as well as for a ‘problem gambler’),” wrote the University of Illinois’ Kindt in the Mercer Law Review. “Theoretically, any gambling facility granting credit (particularly over $200) to a [gambler] has actual or constructive knowledge that the gambler is problematic.”

Bars that serve alcohol to inebriated customers who then injure someone, say by striking that person with their vehicle, can be held liable according to “dramshop” laws. Casinos might similarly be held liable for the financial consequences suffered by gamblers to whom they extend credit beyond a certain limit. In 1994, the widow of a man who killed himself after racking up insurmountable debt at a Mississippi casino sued the casino under an extrapolation of dramshop laws. As her attorney told the Chicago Tribune, “Feeding Eric Kimbrow credit was the equivalent of giving him alcohol.” But her $50 million lawsuit became moot when the casino went bankrupt. So far, no U.S. court has ruled on such a case against a casino and no state legislature has enacted comparable laws that apply to casinos.

Nor should they, according to the gambling industry. “There is no liability to the casino,” says Geoff Freeman, the president and CEO of the American Gaming Association. “There is a set standard to determine inebriation. Nothing of that sort exists to measure what the level is to have gambled too much.”

Stacy Stevens’s suit charged that the Mountaineer Casino, knowing what it knew about her husband and knowing about the harm that can befall gambling addicts, “had a duty to protect Scott Stevens from itself.” She claimed that his suicide was foreseeable by the casino, “yet no attempts were made to intervene.”

Drawing on the research of NYU’s Schüll, the Stevens suit charged that Mountaineer Casino and IGT “have knowingly and intentionally taken advantage of casino patrons, exploiting and causing harm to them, by employing and concealing the present state of gambling with slot machines.” It further claimed that “modern slot machines create, encourage, sustain, and exploit behaviors associated with addiction (e.g., longer, faster, more intensive play)” and that “even when played as intended, slot machines cause users to suffer losses and other detrimental effects.” This formed the foundation of Stacy Stevens’s complaint as a products-liability case: The design of the machines itself, the suit alleged, was responsible for her husband’s addiction and eventual death.

Mountaineer Casino and IGT both declined repeated requests for comment. The casino’s attorneys did maintain the industry position, however, in a motion to dismiss the Stevens complaint, asserting that “nationally utilized and government approved slot machines cannot be found defectively designed or lacking proper warning because of a plaintiff’s unreasonable misuse.”

Mountaineer Casino further maintained the party line that the duty to protect problem gamblers from gambling “belongs to the individual gambler.” As the American Gaming Association’s Freeman argues, “They should have the responsibility to put themselves on a list not to be there.” He is referring to the option states offer residents to voluntarily place themselves on a self-exclusion list, which bans them from gambling activities in that state, and from collecting winnings if they violate the ban. (It does not, however, prevent them from losing money if they visit a casino despite the restriction.) Some experts believe self-exclusion lists are not effective, because they seem to be erratically enforced. Despite the presence of sophisticated surveillance technology, patrons are not routinely screened for their self-exclusion status. “If a self-excluded gambler goes to a casino, it’s okay for them to lose money, but once they start winning, a worker taps the gambler on the shoulder and says, ‘You’re being arrested for trespassing,’ ” says Lorenz, the author of Compulsive Gambling. “Go to any casino, and the gamblers will tell you this is happening with regularity.”

Given that casino operators and slot-machine manufacturers are adamant that the blame for gambling addiction resides with the individual, it is not surprising that research by the industry-funded National Center for Responsible Gaming favors studies directed toward confirming this conclusion. Of the approximately $17 million that the NCRG has allotted for research since its inception in 1996, it has not spent a nickel studying slot machines and the impact they have on those who play them. (According to Chris Reilly, a senior research director at the NCRG, though the majority of the group’s funding comes from commercial casinos and manufacturers, the center maintains a firewall between its contributors and its researchers. Members of the board of directors, she asserts, do not make research decisions, and the center has a separate scientific advisory board.)

“It’s a mistake to focus on the machine, because it’s just this thing,” Reilly says. She says that the problem is rooted in the individual. “We don’t know why the gambler has cognitive disorders” or other issues. “That’s what feeds their addiction.”

That’s not right, says Roger Horbay, the EGM expert and former gambling-addiction therapist. Independent research not funded by the NCRG has shown how false wins, near misses, and other such features influence gamblers, especially the way they perceive expected outcomes. “We’ve been treating these people like they’re messed up, but it’s the machines that are messing them up,” he says. “A lot of the so-called cognitive distortions were actually caused by the machines, not [because the users] were making errors in thinking. Most of them are making correct conclusions based on deceptive information. It’s the lie of the technology that’s the problem.”

Keith Whyte, the executive director of the National Council on Problem Gambling, says that although the industry should have a role in research and public-education efforts, it cannot be effective on its own. (The group, which maintains a neutral stance toward legal gambling, receives a large share of its funding from the industry.) “We can’t rely on the people who provide the product and profit from it to educate the public on the risks,” he says. “It needs to be a broad-based public-health effort.”

Almost a decade after the 1988 Indian Gaming Regulatory Act launched the dramatic expansion of casino gambling into new jurisdictions, the federal government appointed a commission to study the impact of the proliferation. Based on findings that suggested the rate of problem gambling could be twice as high within a 50-mile radius of a gambling facility, the National Gambling Impact Study Commission in 1999 recommended “a pause in the expansion of gambling in order to allow time for an assessment of the costs and benefits already visible, as well as those which remain to be identified.”

Despite that warning, states have been unable to resist the continued expansion of casino gambling. One reason for the ongoing growth is the financial clout of the industry itself. In 2008, when nine states were considering gambling measures, gambling proponents raised more than $167 million, compared with about $106 million by gambling opponents, according to a report by the National Institute on Money in State Politics. “Predatory gambling interests are now the most powerful lobby in the country on the state level because government is a partner with them,” says Les Bernal of Stop Predatory Gambling. “They are literally going out and buying the political process.”

Indeed, experts argue that many states have created a government-gambling complex that implicates them in the casinos’ practices. Many states provide tribal casinos with regional monopolies in exchange for revenues skimmed off the top of casino profits—as much as 30 to 40 percent in some places. West Virginia has a proprietary interest in the slot machines’ software. Kansas actually owns the games and operations of nontribal casinos. New Jersey, Delaware, and Rhode Island have all provided financial bailouts to faltering casinos. “It’s a pretty sleazy way to fund state government,” says Peter Franchot, the comptroller of Maryland. “We have set ourselves up in partnership with a predatory industry … The profits come mainly from a group of addicts that are recruited and nurtured by casinos until they’re out of money.”

Communities typically build casinos based on a mirage of false promises: that they will provide jobs, fund schools, and boost the local economy. But Earl Grinols, an economics professor at Baylor University, in Texas, and the author of Gambling in America: Costs and Benefits, has estimated that every dollar of benefit a casino brings to a community entails about $3 in social costs—whether it’s increased crime, or declining productivity, or more spending on services such as unemployment payments. “It’s a social negative,” Grinols told me. “Casino gambling is bad for the economy. It should not be allowed by anyone, anywhere, anytime.”

In defense of its products and practices, the gambling industry insists that it is heavily regulated and therefore safe. As the attorneys for Mountaineer Casino argued in their motion to dismiss the Stevens suit, “Gaming is highly regulated in each state where it is legalized … If gambling were deemed unsafe or to pose unreasonable harm to citizens … it would not have been legalized.” But this “if it’s legal, it must be safe” argument fails to acknowledge the inadequacies of existing regulations. “Regulators are supposed to protect players and the industry,” says I. Nelson Rose, the author of Gambling and the Law. “But it’s just not at the top of the government’s or industry’s priorities to be thinking about how to protect players.”

Each state in which gambling is legal has set up its own commission to regulate the industry, but there seems to be a symbiotic relationship between regulators and the industry. There are numerous instances of former regulators’ being hired by casinos or other gambling interests. Many gaming-commission members—including those who approve applications for casino licenses—are advised by consultants for private companies also on casino payrolls. “I think society in general has been led to believe that this is a highly regulated and fair industry because the regulators test everything,” Roger Horbay says. “But they would be shocked if they knew even slot machines don’t have to comply with consumer-protection laws.”

Horbay points to informed choice as the central tenet of consumer protection, which is why when you apply for a loan, the bank has to tell you the interest rate and how it’s calculated. It’s why many state lotteries have to disclose their odds, and it’s why even the contests on the backs of cereal boxes list the chances of winning a prize. Yet such essential disclosure is not required of electronic gaming machines. “These machines present all sorts of deceptive trade practices that wouldn’t be allowed in any other industry, not even in other gambling games,” he says. “The standard for game fairness is nonexistent on slots.”

As it happens, the Nevada State Gaming Control Board addressed exactly this question during its 1983 hearings on virtual-reel technology. As Richard Hyte, then a Nevada commissioner, explained, if slot machines were to disclose a player’s odds of winning a payout, that would “take away the mystery, the excitement and entertainment and risk of playing those machines.”

In June, the West Virginia Supreme Court of Appeals ruled on Stacy Stevens’s suit, determining that “no duty of care under West Virginia law exists on the part of manufacturers of video lottery terminals, or the casinos in which the terminals are located, to protect users from compulsively gambling.” The opinion, written by Justice Brent Benjamin, declared that electronic gaming machines

exist in West Virginia for the express purpose of providing an economic boon to the State and its political subdivisions in the form of increased public revenues, to the citizenry in the form of enhanced employment opportunities, and to the racetrack industry for the additional benefit of the dependent local economies.

West Virginia might have been a difficult venue in which to make Stevens’s case. The state has a proprietary interest in the slot machines’ software, and legalized gambling provided more than $550 million in fiscal year 2014, according to the Rockefeller Institute of Government. (For the sake of comparison, the state’s total tax revenues were only about $5 billion.) Little wonder that the court’s ruling focused on the “economic boon,” “increased public revenues,” and “enhanced employment opportunities” provided by gambling, as opposed to the state’s responsibilities to problem gamblers. As Sharon Eubanks, Noffsinger’s co-counsel on the Stevens suit, notes: “What this tells us is the states are addicted to gambling themselves. They seem unwilling to deal with the social costs.”

Les Bernal of Stop Predatory Gambling agrees that the close relationship between the state and its gambling interests was crucial: “I don’t think it has something to do with it; I think it has everything to do with it. Essentially what the West Virginia Supreme Court has said is that gambling interests in West Virginia are immune from liability.”

In West Virginia, Indiana, and other states, the courts have deferred to the state legislatures’ intentions in their decisions, but the legislators don’t always know better—in part because they may have been informed principally by gambling interests. Former West Virginia House Majority Leader Rick Staton has expressed regret over his role in expanding legalized gambling in the state. “I think we got, no pun intended, played,” he told the Charleston Gazette. He’s not alone. Stan Rosenberg, the president of the Massachusetts Senate, helped lead his state’s drive to legalize casinos in 2014 despite being unaware of near misses, false wins, and other EGM practices. “I don’t know the engineering and science of it,” he admits.

Noffsinger concludes that this “is basically the end of our efforts in West Virginia.” But he believes the movement to hold casinos liable for problem gambling is only building momentum: “One of the things that has happened is that the public is learning more about it. There have been more people who have lost a lot of money, there have been more people who have had to file bankruptcy, there have been more people who have embezzled, there have been more people who have committed suicide. What’s amazing to me is that not one time has the evidence that we alleged in our complaint been tested in a court of law with sworn testimony and a trial and a ruling.”

And that, according to several experts, is what it will probably take—a court trial, which would open access to private industry documents. “The industry knows if any court gets to the point of discovery, they’re in real trouble,” says Kindt, from the University of Illinois at Urbana-Champaign. “They know what they’ve got in their marketing plans and their documents. They cannot afford to have that made public, because it would confirm what everybody knows: that one- to two-thirds of their income comes from the roughly 10 to 20 percent of their customers who are pathological and problem gamblers.” Kindt continued, “The Stevens case is getting good publicity and national recognition. The more lawyers read about it, the more they are going to start smelling blood in the water. It just takes for a case to be brought up in the right jurisdiction.”

On his last Christmas, shortly before he lost his job, Scott Stevens did not buy his wife or three daughters any presents, and he couldn’t bring himself to open the presents they had bought him. He didn’t feel that he deserved them, and he gave in only after his daughters begged him. A photograph of him later that week, when he was deep-sea fishing in Cabo San Lucas, a place that usually brought him happiness, reveals the heaviness in his expression—his eyes defeated, his smile gone.

In the months after he was fired, Stevens tried taking the antidepressant Paxil and saw a therapist, but he did not admit to Stacy that he was still gambling almost every day. As spring turned into summer, he knew that charges from the IRS were forthcoming following its investigation into his embezzlement and that even after serving time in prison, he would likely still be on the hook for the hundreds of thousands of dollars he owed in back taxes and penalties. His former employer seemed close to pressing charges, having put the police on notice. He would never be able to work in the financial sector again. Once the affair hit the papers, his family would be dragged through the gantlet of small-town gossip and censure. He could see no way to spare them other than to sacrifice himself.

By mid-afternoon on August 13, 2012, Stacy had started to worry. Why hadn’t Stevens responded to her texts? That wasn’t like him. She texted him that they would eat dinner early to accommodate the girls’ evening activities. “Why aren’t you answering me?” she texted. But she got no response until about an hour later, when he sent his last text to her: “I love you.”

Distressed, Stacy responded, “Honey, I love you. Please come home.” She telephoned his therapist to ask whether she had seen him, but to no avail.

Shortly after that, Stacy’s phone rang. It was Tim Bender, the Cleveland tax attorney helping Stevens with his IRS troubles. Stevens had just called him. Bender had tried to talk him out of killing himself, but Stevens had hung up. Bender said he would call 911.

All Stacy could do was pray: “Please, God. Please, please, please. Let things be okay.”

Then she heard sirens. Lots of them.

Police officers from the neighboring town of Wintersville arrived at the soccer fields within six minutes of Stevens’s own 911 call. They found Stevens sitting on the railroad tie by his Jeep. Two sheriff’s deputies and an Ohio highway patrolman also pulled into the complex.

They spoke to Stevens across the gravel parking lot.

“Stand up. Show us your hands.”

But Stevens was not going to back down. This was his family’s only chance, his final gamble.

He raised the muzzle of the shotgun to his chest, reached for the trigger, and squeezed.

© John Rosengren